💡 What is the 50/30/20 Budgeting Rule?

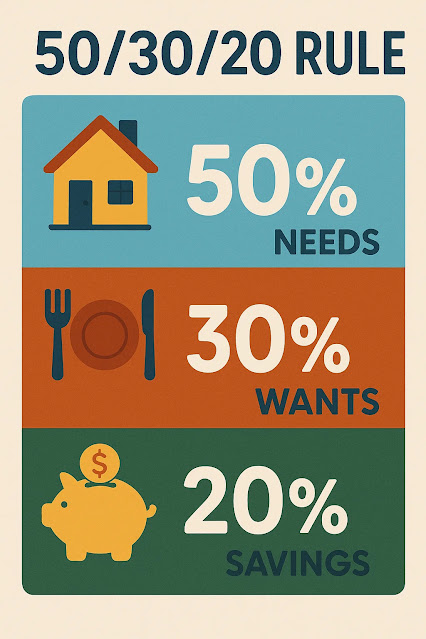

The 50/30/20 rule is a simple, effective budgeting framework that helps you divide your monthly income into three major spending categories:

- 50% for Needs

- 30% for Wants

- 20% for Savings & Debt Repayment

Popularized by U.S. Senator Elizabeth Warren in her book "All Your Worth: The Ultimate Lifetime Money Plan", this rule simplifies budgeting, making it ideal for beginners, students, young professionals, and anyone trying to gain better control of their finances in 2025.

✅ Why Use the 50/30/20 Rule in 2025?

In a time of economic uncertainty, rising costs, and changing work dynamics (freelancing, remote work, gig economy), traditional budgeting can feel complicated. That’s where the 50/30/20 rule comes in:

- Simplicity: Easy to understand and implement

- Flexibility: Works with any income level

- Focus: Prioritizes needs, reduces overspending

- Goal-Driven: Encourages savings and debt reduction

🔍 Step-by-Step Breakdown of the 50/30/20 Rule

Let’s explore how each category works:

🔹 1. 50% – Needs

Definition: Essential expenses you absolutely must cover to live and work.

Includes:

- Rent or mortgage

- Utilities (electricity, water, gas)

- Transportation (gas, public transport, car payments)

- Insurance (health, car)

- Minimum loan payments

- Groceries and basic food

- Childcare or tuition fees (if mandatory)

Example: If your monthly after-tax income is $3,000, your “Needs” should be no more than $1,500.

Tip: If your needs exceed 50%, reduce discretionary expenses or explore more affordable alternatives.

🔹 2. 30% – Wants

Definition: Lifestyle choices or “nice-to-haves” that enhance your quality of life.

Includes:

- Dining out, takeout, or delivery

- Entertainment (Netflix, concerts, hobbies)

- Shopping (clothing, gadgets, gifts)

- Gym memberships or spa treatments

- Travel and vacations

Example: From a $3,000 income, your “Wants” budget would be $900/month.

Important: Wants are not inherently bad—they’re part of a balanced lifestyle. The rule just helps keep them in check.

🔹 3. 20% – Savings and Debt Repayment

Definition: Money set aside for future goals or paying off debt faster than the minimum.

Includes:

- Emergency fund contributions

- Retirement savings (IRA, 401k)

- Investment accounts

- Extra loan or credit card payments

- High-yield savings account contributions

Example: $600/month from a $3,000 income goes into savings or paying off debt.

Goal: Build at least 3–6 months of expenses in an emergency fund and focus on high-interest debt first.

🧠 How to Calculate the 50/30/20 Rule

- Start with your net income: That’s your take-home pay after taxes and deductions.

- Break it down:

- Multiply by 0.50 for needs

- Multiply by 0.30 for wants

- Multiply by 0.20 for savings

📊 Example:

| Monthly Net Income | Needs (50%) | Wants (30%) | Savings (20%) |

|---|---|---|---|

| $2,500 | $1,250 | $750 | $500 |

| $4,000 | $2,000 | $1,200 | $800 |

| $6,000 | $3,000 | $1,800 | $1,200 |

🛠️ Tools to Help You Use the 50/30/20 Rule

Here are some free tools and apps to make budgeting easier:

✅ Free Budgeting Tools

| Tool | Features | Website |

|---|---|---|

| Mint | Auto tracks expenses, categories, goals | mint.intuit.com |

| You Need A Budget (YNAB) | Free trial, manual tracking, zero-based budgeting | ynab.com |

| Goodbudget | Envelope budgeting, mobile-friendly | goodbudget.com |

| Google Sheets | DIY budgeting templates, 100% customizable | Google Sheets |

💬 Pros and Cons of the 50/30/20 Rule

✅ Pros:

- Beginner-friendly

- Encourages savings

- Prevents lifestyle inflation

- Adaptable to irregular income

❌ Cons:

- May not be realistic in high-cost cities

- Doesn’t factor in aggressive savings goals

- Might be too simplified for complex finances

🔁 Adapting the Rule for Different Lifestyles

🎓 Students & Part-Timers

Try 60/20/20 or even 70/10/20 if your income is very low. Focus more on needs and saving small amounts.

👨👩👧👦 Families

Adjust based on household income. Create shared goals and plan for family expenses (childcare, schooling, healthcare).

💼 Freelancers or Gig Workers

Budget based on average monthly income. Create a buffer for months when work is slower.

💸 5 Budgeting Tips for Beginners

- Automate savings: Set up auto-transfers to savings or investments.

- Use cash envelopes for better discipline.

- Review monthly: Your needs and wants may shift.

- Avoid debt traps: Pay credit cards in full each month.

- Track every dollar: Awareness is the first step to control.

📌 Real-Life Example of the 50/30/20 Rule

Case Study: Sarah, a Freelance Graphic Designer

- Net Income: $4,000/month

- Expenses:

- Rent: $1,200

- Utilities: $200

- Food: $400

- Wants: $1,000 (travel, shopping)

- Savings: $1,200 (emergency fund, investing)

👉 Her spending falls roughly within the 50/30/20 split:

- Needs: $1,800 → 45%

- Wants: $1,000 → 25%

- Savings: $1,200 → 30%

Outcome: She prioritizes savings without giving up quality of life.

🧾 Alternative Budgeting Methods to Consider

If the 50/30/20 rule isn’t quite right for your financial goals, consider:

- Zero-Based Budgeting: Assign every dollar a purpose

- Envelope Method: Use cash for different categories

- 70/20/10 Rule: Good for high earners focused on saving

🧭 Final Thoughts: Should You Use the 50/30/20 Rule?

The 50/30/20 budgeting rule is an excellent starting point for anyone looking to get their finances in order without stress or spreadsheets. It promotes balanced living, smart saving, and responsible spending—all vital for financial success in 2025.

Whether you're saving for your first home, paying off student loans, or just trying to stop living paycheck-to-paycheck, this method gives you a clear, flexible roadmap to follow.

📚 FAQs

❓ Is the 50/30/20 rule gross or net income?

Use your net income (after taxes) to apply this rule.

❓ What if my needs are more than 50%?

Reduce “wants,” find cheaper alternatives, or increase income with side gigs.

❓ Can I modify the percentages?

Yes! Use this as a framework. Adjust based on your lifestyle, city, and goals.